Receba o valor justo pelo seu trabalho e nunca mais fique refém dos planos de saúde.

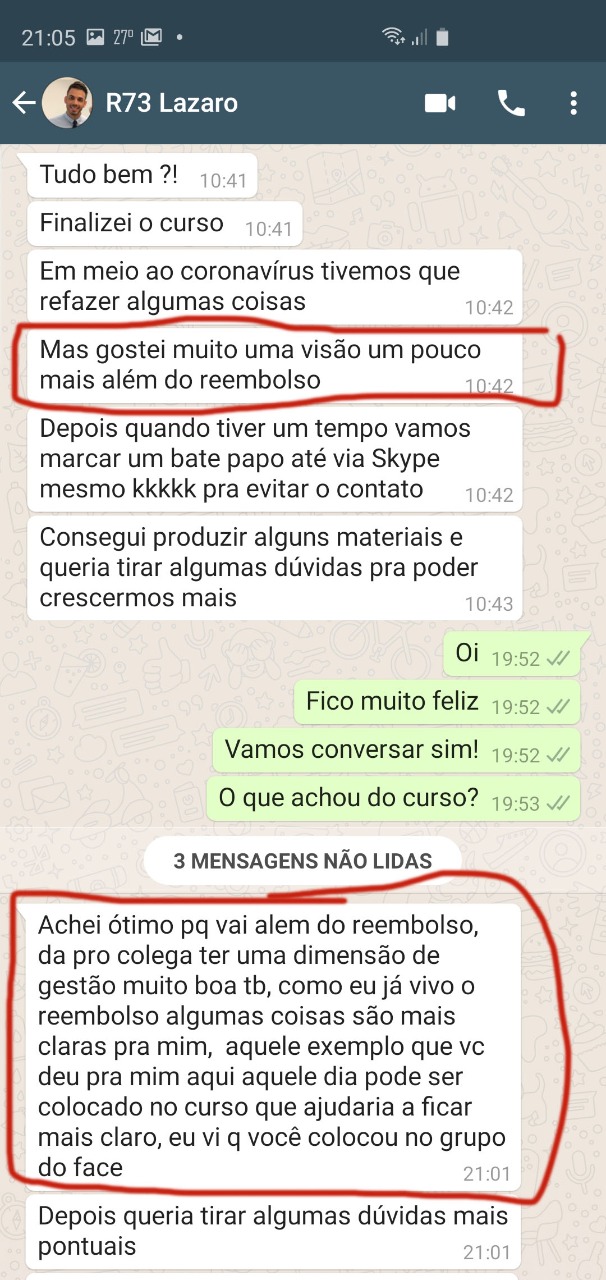

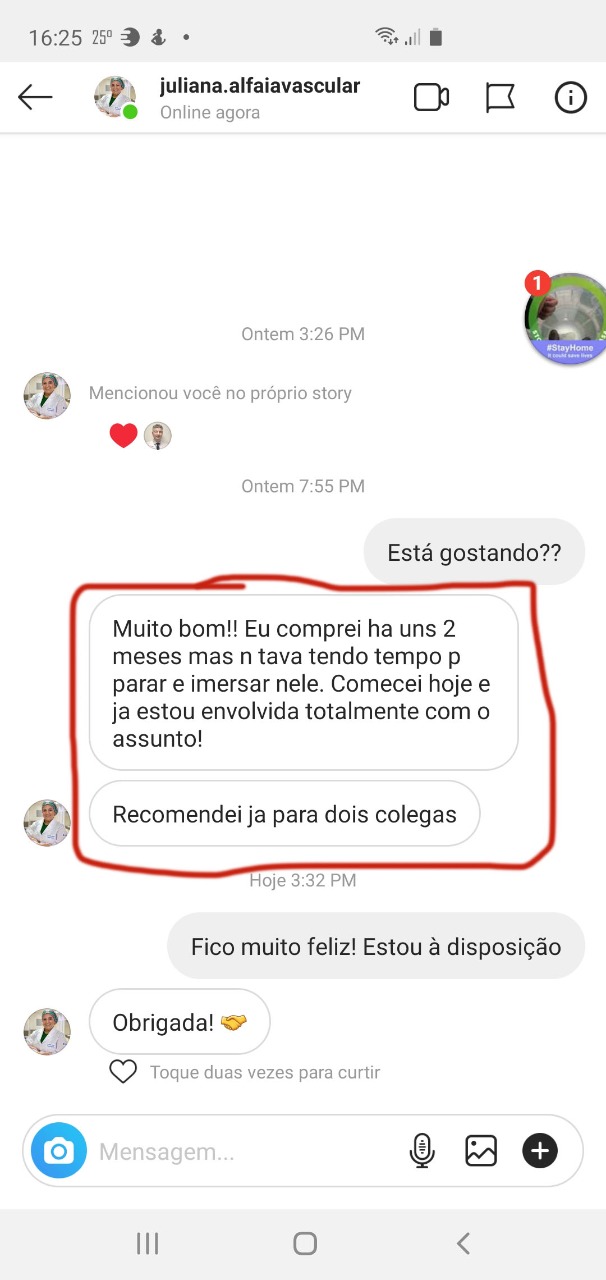

Alunos(as) Lucrando

Aumento no lucro

Curso com Carga Horária Completa

Médico, Cirurgião Vascular e Endovascular.

Doutor em Ciências pela USP. MBA em Gestão em Saúde pela FGV.

Professor de Cirurgia Vascular da Faculdade de Medicina da UNISA.

Especialista em Cirurgia Geral pelo Colégio Brasileiro de Cirurgiões.

Especialista em Cirurgia Vascular, Endovascular e Angiorradiologia pela AMB e SBACV.

Especialista em Ecografia Vascular pelo CBR.

O processo do reembolso para o médico é tão eficaz e com retorno financeiro tão diferenciado que as operadoras de saúde estão tentando bloquear o uso do reembolso e este curso de qualquer maneira!

Esse é um documento real recebido pela nossa equipe...

Por ser algo TOTALMENTE LEGAL, estão tentando assustar e dificultar.

Portanto, se você quer maior valorização do seu trabalho, garanta o seu acesso imediatamente.

Comece a utilizar o Reembolso Médico no seu consultório ou clínica e veja seu faturamento crescendo em até 30%

Com o Reembolso Médico você não fica mais refém das tabelas dos planos de saúde e pode cobrar o valor que você merece pelas consultas, exames, cirurgia ou qualquer outro procedimento.

Com o Reembolso Médico seu paciente pode realizar os procedimentos necessários com você, mesmo que o plano de saúde dele não tenha cobertura.

Com o Reembolso Médico seu paciente não terá nenhum gasto extra, pois será reembolsado pelo plano de saúde.

O autor do curso possui anos de experiência aplicando o Reembolso Médico e desenvolveu uma metodologia que já ajudou dezenas de médicos de todo o país.

Ao aprender a usar o reembolso e aplicar no seu dia a dia, naturalmente estará se capacitando para o paciente particular.

Veja os pré-requisitos abaixo e descubra se o Curso de Reembolso Médico é para você.

O Curso é dividido em 2 Fases, da primeira à segunda fase você irá literalmente aprender do ZERO ao AVANÇADO.

Na atual crise ética e moral em que vivemos, lembrar os valores éticos que pautam nossas vidas é essencial

Conheça os fundamentos do Reembolso Médico

Usando o Método do Reembolso Médico para Consultas

O Reembolso da Cirurgia requer a elaboração da prévia do reembolso

A obtenção das informações sobre os valores de Reembolso de exames

Descubra as Operadoras que mais pagam Reembolsos

Capacite a sua Equipe de atendimento para realizar o Reembolso Médico

Descubra todos os outros tipos de Reembolso

Como aplicar noções de gestão de projetos no reembolso

Você precisa de um advogado? Onde ele pode ajudar?

A auditoria não é algo a temer. É uma ferramenta de gestão

A contabilidade pode ajudar a economizar se for bem utilizada

Aprenda como gerenciar os custos durante o processo

A gestão de pessoas é essencial na administração de uma clínica

Aprenda como gerenciar os serviços de saúde no processo

Aprenda como aplicar logística no processo de reembolso

Aprenda planejamento e gestão estratégica no reembolso

Aprenda como aplicar qualidade e acreditação no processo

Aprenda responsabilidade social no processo de reembolso

Aprenda sistemas integrados de gestão no reembolso

Eu poderia tranquilamente te cobrar um valor na casa de 5 Mil reais ou até mesmo na casa de 10 Mil Reais!

O valor que o curso online de Reembolso Médico já proporcionou nos aumentos de faturamento dos alunos estão dentro desses números, eficácia e resultado comprovado.

Entretanto, para que fique mais acessível, preparei uma proposta irrecusável:

De: R$4997

POR APENAS 12x de

R$413,38

ou R$3997 à vista

Quero Ter Acesso às Estratégias para Aumentar meu Faturamento AGORA MESMO!O CURSO PODE SER TIRADO DO AR A QUALQUER INSTANTE.

Investindo apenas R$ 10,95 por dia, ou seja, POR UM VALOR EQUIVALENTE A UM CAFEZINHO E UM PÃO NA CHAPA NA PADARIA, VOCÊ PODE TER ACESSO A TUDO ISSO!

Adquirindo o Curso de Reembolso Médico AGORA, você ainda receberá TODOS estes bônus:

Nessa aula você aprenderá como funciona o reembolso médico nos EUA e como nós podemos melhorar no Brasil.

O objetivo do Guia é esclarecer as dúvidas mais comuns em contratos de serviços de saúde suplementar.

Você conhecerá corretoras que poderão te ajudar e te economizar tempo durante o processo do Reembolso Médico.

Você terá acesso exclusivo a um grupo secreto no Facebook onde os alunos poderão trocar informações e tirar dúvidas.

Satisfação 100% Garantida! Você não precisa decidir agora, você pode degustar, aplicar, lucrar e se por algum motivo não se sentir satisfeito com o curso, você tem um prazo especial de 7 dias para pedir todo o seu valor investido de volta.

Basta enviar um e-mail para [email protected]

Independente de Onde é a sua Clínica/Consultório, o Curso Online Reembolso Médico é o mais completo, e válido para Qualquer Lugar do Brasil

Quero Garantir Minha Vaga!Acesso Fácil e por qualquer Dispositivo Móvel (celular, computador, tablets...)

Se o curso completo ainda não é para você neste momento, conheça o livro "O Reembolso Médico"

O Reembolso Médico é a maneira mais inteligente de atuar na saúde. O equilíbrio entre o poder decisório, a informação médica e o poder financeiro permite a realização da medicina sem influência de interesses escusos.

Para o paciente, ele recebe a informação de saúde da fonte, sem filtro econômico da operadora de saúde. Para o médico, não há influência da operadora de saúde nas suas recomendações.

Este livro ensina a aplicar o Reembolso Médico em sua prática diária. Todo médico tem que saber como o Reembolso Médico funciona, quais são os seus direitos e os direitos dos pacientes.

Converse com nosso assistente virtual ou envie um e-mail para [email protected]

acabou de se inscrever no curso!